How Medicare Graham can Save You Time, Stress, and Money.

How Medicare Graham can Save You Time, Stress, and Money.

Blog Article

The Only Guide for Medicare Graham

Table of ContentsHow Medicare Graham can Save You Time, Stress, and Money.What Does Medicare Graham Do?The 8-Minute Rule for Medicare GrahamThe Medicare Graham IdeasMedicare Graham Can Be Fun For Anyone

An individual that joins any of these policies can grant power of attorney to a trusted individual or caretaker in situation they come to be incapable to handle their events. This suggests that the individual with power of lawyer can provide the plan in support of the strategy owner and see their medical information.

How Medicare Graham can Save You Time, Stress, and Money.

Be sure that you recognize the additional advantages and any advantages (or liberties) that you might shed. You might wish to take into consideration: If you can change your present medical professionals If your drugs are covered under the plan's drug checklist formulary (if prescription drug coverage is offered) The regular monthly costs The price of coverage.

What additional services are provided (i.e. precautionary care, vision, dental, health and wellness club membership) Any type of therapies you need that aren't covered by the strategy If you wish to register in a Medicare Benefit plan, you must: Be eligible for Medicare Be registered in both Medicare Part A and Medicare Part B (you can inspect this by describing your red, white, and blue Medicare card) Live within the plan's service area (which is based upon the area you live innot your state of residence) Not have end-stage renal condition (ESRD) There are a couple of times throughout the year that you may be eligible to change your Medicare Advantage (MA) strategy: The takes place yearly from October 15-December 7.

Your brand-new protection will begin the very first of the month after you make the switch. If you require to alter your MA plan outside of the standard enrollment durations defined above, you may be qualified for an Unique Registration Period (SEP) for these qualifying events: Relocating outdoors your plan's protection location New Medicare or Component D plans are available as a result of an action to a brand-new long-term location Lately released from prison Your strategy is not restoring its contract with the Centers for Medicare & Medicaid Provider (CMS) or will certainly stop supplying advantages in your location at the end of the year CMS might also develop SEPs for particular "exceptional problems" such as: If you make an MA enrollment request right into or out of an employer-sponsored MA plan If you intend to disenroll from an MA plan in order to enroll in the Program of All-inclusive Look After the Elderly (SPEED).

The Ultimate Guide To Medicare Graham

resident and have ended up being "legally present" as a "professional non-citizen" without a waiting period in the USA To confirm if you're eligible for a SEP, Medicare Lake Worth Beach.contact us. Medicare West Palm Beach.

Third, take into consideration any type of clinical solutions you might require, such as confirming your current doctors and professionals approve Medicare or finding coverage while away from home. Read about the insurance firms you're taking into consideration.

Not known Incorrect Statements About Medicare Graham

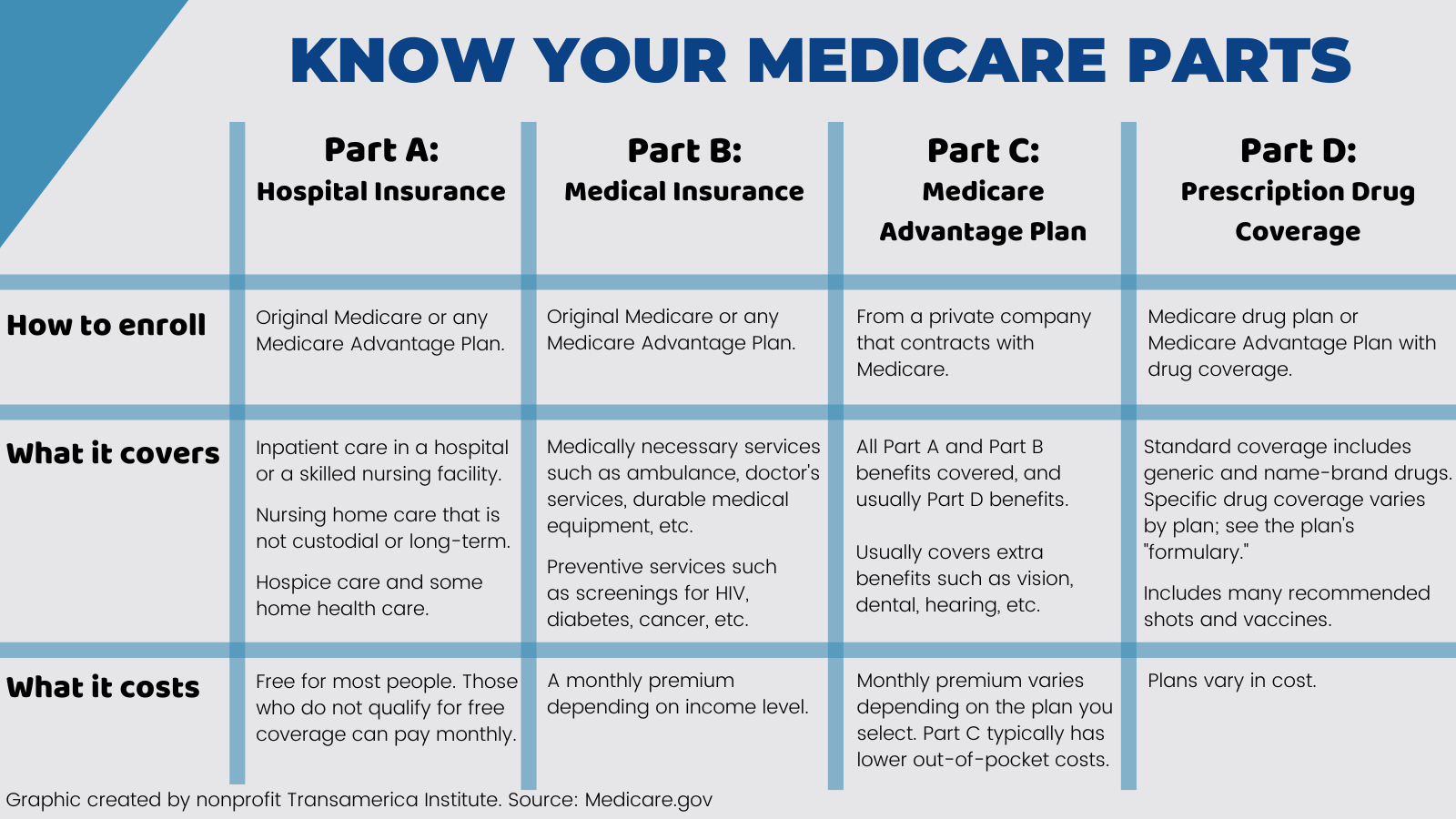

To pick the right coverage for you, it is very important to recognize the fundamentals about Medicare - Medicare West Palm Beach. We've collected every little thing you need to learn about Medicare, so you can pick the plan that ideal fits your requirements. Allow's walk you via the process of just how to analyze if a Medicare supplement plan might be best for you.

Medicare supplement plans are streamlined right into classes AN. This category makes it simpler to contrast several supplementary Medicare plan kinds and pick one that finest fits your requirements. While the basic benefits of each sort of Medicare supplement insurance coverage strategy are consistent by copyright, costs can differ between insurance policy companies.: browse around this site Along with your Medicare supplement plan, you can select to acquire added coverage, such as a prescription drug strategy (Component D) and oral and vision coverage, to assist satisfy your details needs.

You can find an equilibrium in between the plan's expense and its insurance coverage. High-deductible plans supply low costs, however you may need to pay more expense. Medicare supplement policies typically have a constant, foreseeable bill. You pay a month-to-month premium for low or no extra out-of-pocket prices.

Medicare Graham for Dummies

For example, some strategies cover international traveling emergencies, while others omit them. Provide the clinical services you most value or may need and make certain the strategy you pick addresses those needs. Personal insurance provider provide Medicare supplement plans, and it's a good idea to check out the great print and contrast the worth various insurance providers provide.

It's constantly an excellent concept to speak to representatives of the insurance companies you're thinking about. Whether you're switching Medicare supplement strategies or purchasing for the very first time, there are a few points to think about *.

Report this page